For manufacturers and procurement managers, timing is everything. In the wholesale metal market, a small fluctuation in price per ton can mean the difference between a profitable quarter and a budget overrun.

As we settle into the new year, it is clear that the aluminum market outlook is facing a unique set of pressures compared to previous years. From shifting trade regulations to the global energy transition, the cost of raw material is being pulled in different directions.

In this article, we analyze the aluminum price trends 2026 to help buyers understand the market and make smarter purchasing decisions.

1. The “Green Aluminum” Premium & Carbon Taxes

The most significant shift in 2026 is the decoupling of prices between “high-carbon” (coal-based) and “low-carbon” (hydro-based) aluminum.

The Split: Historically, aluminum was just aluminum. Now, buyers in Europe and North America are demanding metal with a low carbon footprint to meet ESG goals.

The Regulation: Policies like the EU’s Carbon Border Adjustment Mechanism (CBAM) are effectively placing a tax on carbon-heavy imports.

The Impact: If your company exports finished goods to Europe, you may need to pay a premium for green aluminum. These environmental regulations are now major factors affecting aluminum prices, creating a two-tier price system in the global market.

2. Energy Costs and Smelting Output

Aluminum is often described by economists as “solid electricity” because the smelting process requires such massive amounts of power. Therefore, the cost of energy is the primary driver of the base metal cost.

The Reality: In 2026, energy volatility in key smelting regions remains a threat. If natural gas or coal prices spike during winter or summer peak seasons, smelters may curtail production to save money.

The Result: When production is cut, supply tightens immediately, driving up the base price for everyone.

3. Global Inventory Levels (LME & SHFE)

To understand where prices are going, we must look at the stockpiles at the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE).

Current Status: Inventory levels in Western markets remain relatively tight due to ongoing sanctions and trade barriers on specific origins of metal.

The Price Floor: Low global inventories create a “price floor.” This means that even if demand slows down slightly, the LME aluminum price is unlikely to crash because there is simply not enough surplus metal in the warehouses to flood the market.

4. Demand from Key Growth Sectors

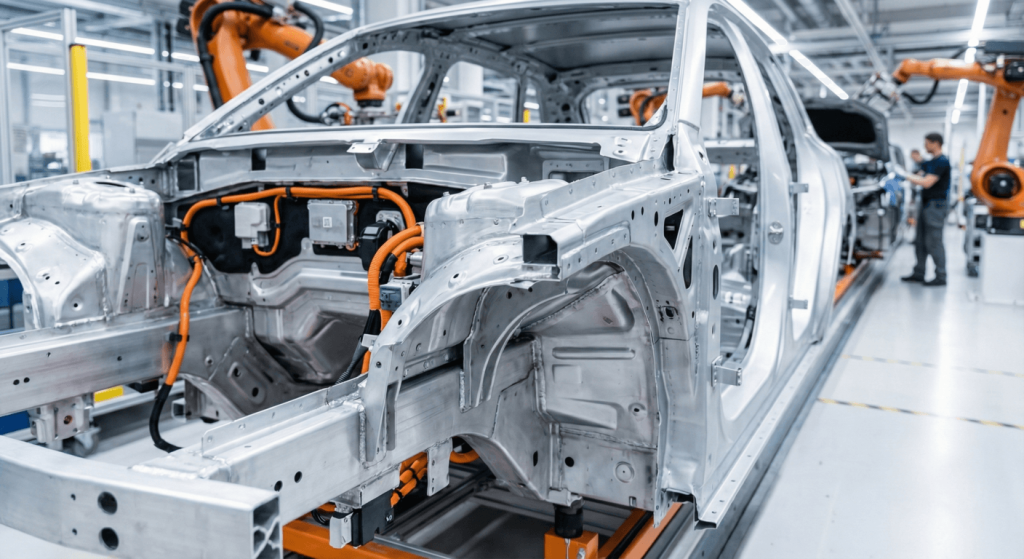

Despite economic fluctuations, demand for aluminum is robust because it is essential to the industries that are growing the fastest.

Electric Vehicles (EVs): The “lightweighting” trend is non-negotiable for EVs to increase range. This is driving massive demand for 5000 and 6000 series aluminum sheets for battery casings and body panels.

Solar Energy: The global push for renewable energy requires tons of aluminum for photovoltaic frames and mounting structures.

The Outlook: As long as these industries continue to expand, the aluminum market outlook will remain positive, preventing prices from dropping significantly.

5. Logistics and Freight Costs

Smart buyers know that the “price” on the invoice includes delivery. In 2026, logistics remain a wild card.

Ocean Freight: While more stable than the post-pandemic years, shipping lanes are still vulnerable to regional conflicts which can add “war risk surcharges” to your bill.

Currency Exchange: Most international metal is traded in USD. The continued strength of the US Dollar means that for importers in many countries, the final landed cost is higher, even if the metal price stays flat.

Conclusion: How Buyers Should Prepare

The forecast for 2026 suggests continued volatility with a long-term upward trend for high-quality, certified alloys.

Our Advice:

Don’t wait for a crash: With low inventories, a massive price drop is unlikely.

Consider Forward Buying: If you have predictable production needs, talk to your supplier about locking in prices now to protect your budget for the next 6 months.

Looking for a Reliable Factory? We monitor these global trends daily and adhere to strict Aluminum Association standards to ensure we offer the most competitive rates. Contact us today to check our current inventory and buy aluminum sheet wholesale at a price that works for your business.